How Listed Investment Companies Charge Double The Fees - Part 1, A Bunch of LIC Heads

I’m lucky that I work for myself, so I can call out some of the bullshit and rapacious largesse in financial services.

This post is the first in a series of posts on Listed Investment Companies (LICs), outlining how they are the worst investment available to Australians today.

I hate LICs. I’ve always hated LICs. Let me note, there are a few good ones, and there has been honourable reasons for their listing and still have honourable fund managers of them. But even the good ones are bad investments today.

The best analogy for LICs, is that they are Video Rental stores, in the 80s and 90s, they were fantastic, a brilliant service.

However, in 2023 the world has moved past them, and they are thoroughly redundant, not just redundant, but inferior.

There are four key problems with LICs:

Fees, which can be obscenely high, are often hidden and not obvious.

LIC’s corporate structure traps investors. Investors lose power, management has less accountability, investors can suffer at management’s gain.

The way LICs trade regularly forces investors to sell at discounted values.

LICs are an inferior corporate structure that is intensely vulnerable to tax reform.

The key problems detailed above are not an exhaustive list of the issues with LICs, there are others, such as their historical payment of commissions.

This article however, focuses on one, not necessarily the worst, but the one which infuriates me the most, Fees.

Again, not all LICs fee gougers, this blog will outline the ones that are.

Unit Trusts vs Companies

Fees are a part of investing. Fund managers aka the people that manage money, have costs, earn salaries. I’d argue they’re obscenely overpaid, but it should be clear how they are paid and what they are paid.

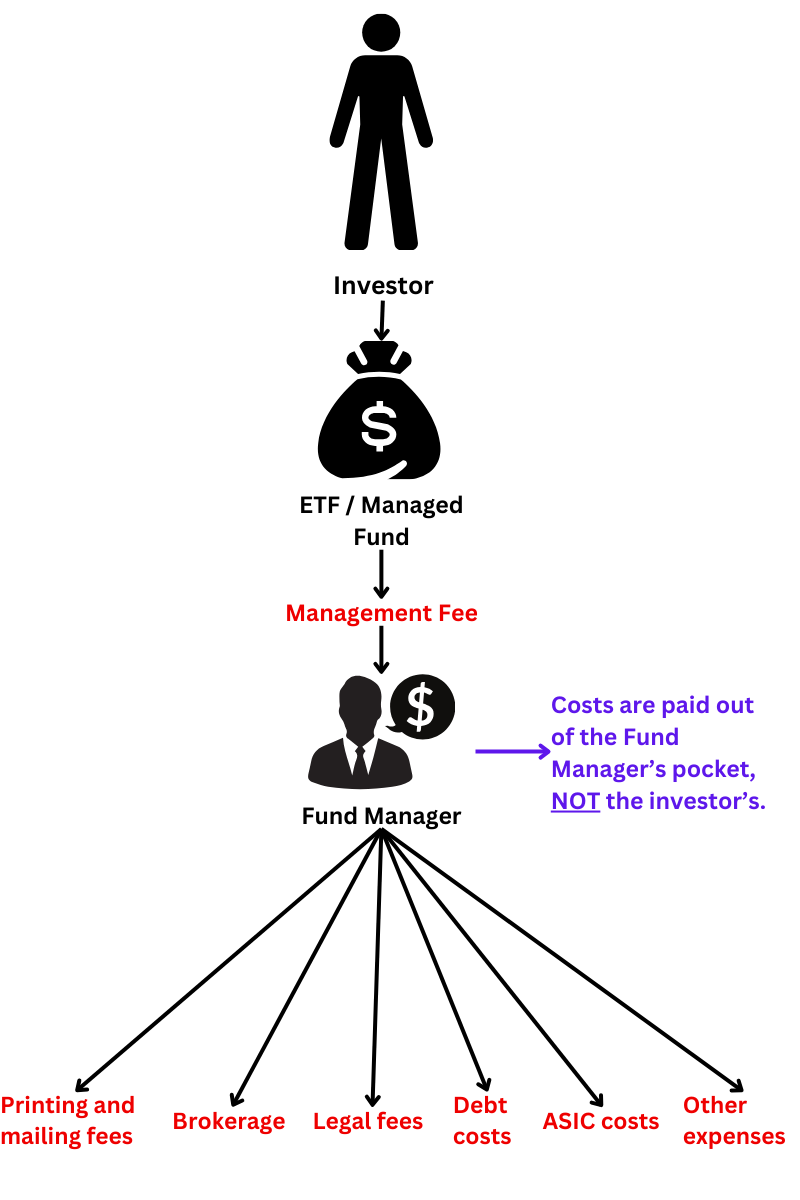

The most common form is a ‘Unit Trust’, which represents ETFs, Managed Funds and often Superfunds.

This is what a Unit Trust looks like with respect to fees & costs:

Pretty simple and reasonably transparent. It can still be bloody expensive for investors, but it’s transparent.

Now, let’s talk about LICs. LICs aren’t unit trusts, they’re Ltd “Companies”.

Now for the purpose of this article, there’s two kinds of LICs, internally managed and externally managed.

Internally managed LICs include ones like Argo, AFIC, by and large, these are the “good guys”, and their fees are incredibly low, the investments are still inferior to an ETF, but with respect to Fees, they’re low.

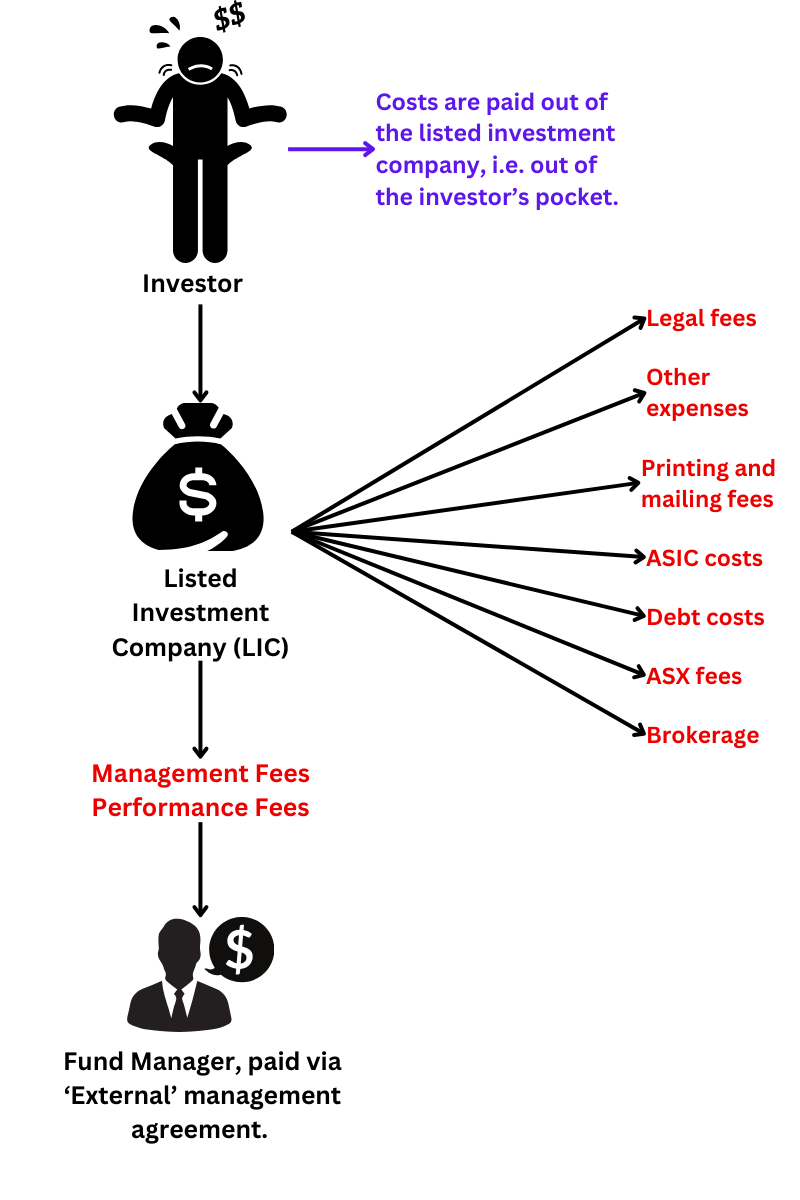

Then, you have Externally Managed, here is where you can find truly obscene costs.

Here’s what an Externally Managed Listed Investment Company looks like:

In essence, what they are doing is double dipping. It’s a sweet deal for management.

Let me be clear, these costs should be borne by the fund manager, not the investors.

Imagine this, and I’ll use an industry that was about as ripe for disruption and as focused on ripping people off as Listed Investment Companies, i.e. taxis.

You catch a cab to the airport, cabbie says, that’ll be $50.

Fair enough, you hand the cabbie $50. Deal is complete.

The cabbie pays his fuel, wear & tear on the car, tyres, toll roads, and doesn’t bother cleaning it. Simple. That’s a managed fund, ETF or super fund aka a Unit Trust. They charge a fee, they pay their own costs.

Then, there’s an externally managed LIC.

You catch a cab to the airport, LIC-Cabbie says, “that’ll be $50”, but, also says LIC-Cabbie, you owe me $20 for fuel, $10 for wear & tear on the car, $5 for the GPS, $10 to wash my uniform tonight and $5 for the smell of feet I provided.

You might say, well what the fudge was the first $50 for? Pure profit for you? This trip just cost me $100.

And the LIC-Cabbie would say, “How dare you, that’s my Management Fee, as per the constitution for the company and disclosed in the prospectus of this here Toyota Camry!”.

That’s what LICs can and will do, they can ram seriously big costs onto the investors, thus keeping enhancing already incredibly large management fees as pure cream.

Bear in mind, people become billionaires on those management fees alone, the business is already one of the highest margin operations in human history, fund managers aren’t starving in their harbourside mansions, they don’t need to double dip.

Performance Fees

In addition to fat management fees, many LICs incorporate unbelievably profitable performance fees.

Now, performance fees aren’t uncommon, but with LICs they can be particularly toxic.

Firstly, by virtue of being less regulated than Managed Funds, LICs can write in some relatively high fees and tricky arrangements.

Secondly and more importantly, the problem with performance fees relates to another major issue with LICs and that is trading at a discount.

Let’s say you have a managed fund, the fund manager beats the market by 10%, after fees, and in turn, they earn a fat performance fee of 20%. Well, your investment with them still went up by more than the market, so money well spent.

Let’s say you have a LIC, and the fund manager beats the index by 20%, well, same thing, they will charge that fee, however, there’s no guarantee that the investor sees the profit.

If a managed fund grows by 20%, the investors holding grows by 20%.

If a LIC’s portfolio grows by 20%, an investor’s shares might grow, or they might not.

If you look across the LIC universe, a lot don’t….. and less do every year.

So, with LICs, often you can get all of the fees, with none of the performance….

Flood Damage

Performance fees are complicated, and no investment embodies how festy they can get then LICs.

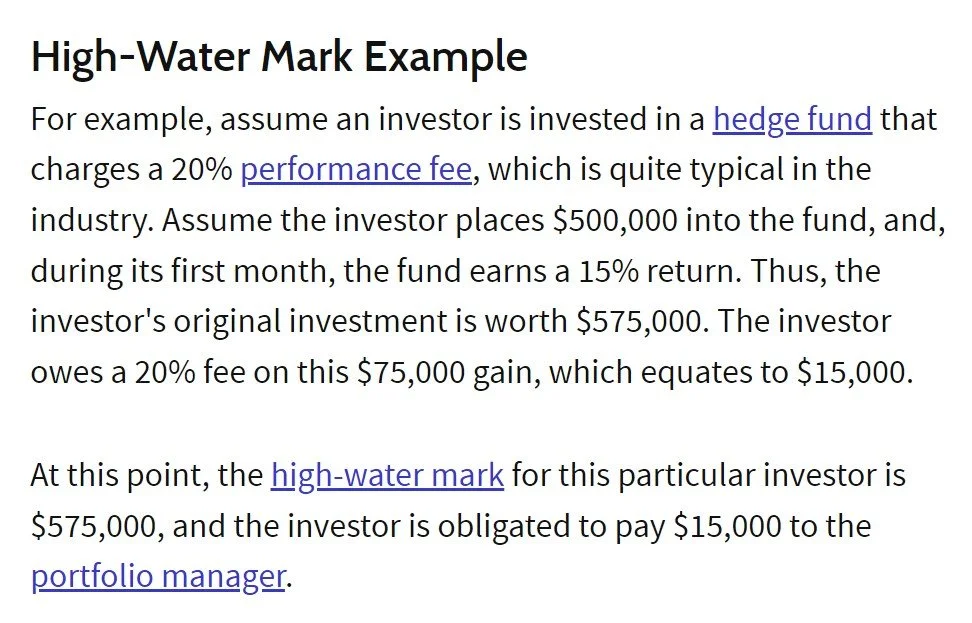

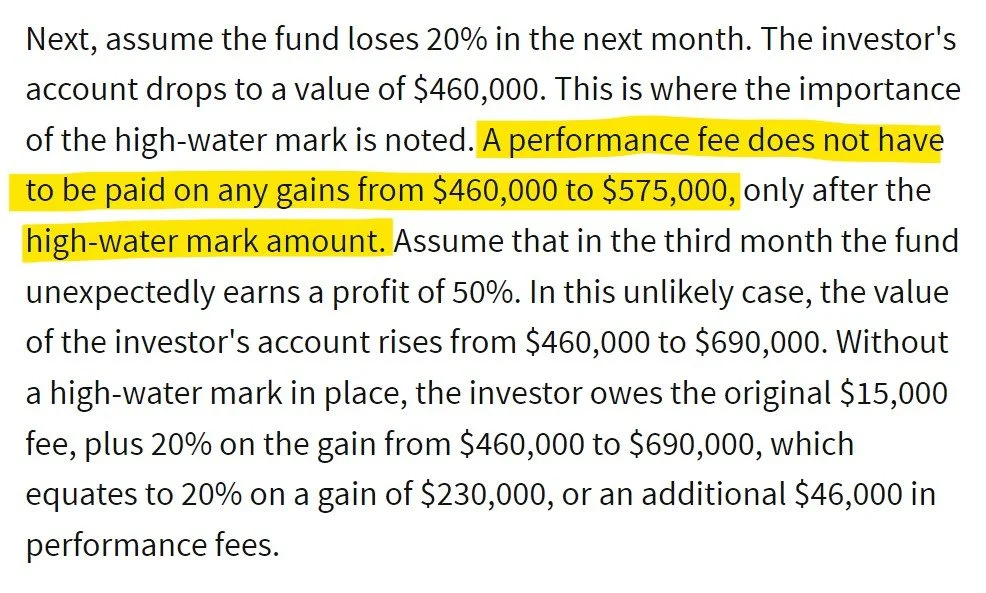

Generally, there’s something called a “High Watermark”. Essentially, this means the manager does not get paid large sums for poor performance.

A high-water mark is different from a hurdle rate, which is the lowest amount of profit or returns a hedge fund has to earn to charge an incentive fee.

High watermarks prevent managers double- dipping on performance fees (as if LICs didn’t double dip enough).

Secondly, if a manager doesn’t have a high watermark, it can be argued that the manager is incentivised to take wild swings, rather than deliver steady profits.

Performance fees are high, they’re commonly 20%, and these fees can cost investors incredible amounts of money in fees.

Some LICs don’t have high watermarks.

This means the manager is incentivised to take big swings, with no repercussions. This is a toxic combination with LICs being closed-ended where the manager has significantly less accountability.

Meaning, a manager LIC is much less likely to lose compensation from poor performance, as their investors can only leave when they find someone else to take their place.

It’s great for managers and a really shitty deal for investors.

How big can these fees get?

Again, this is not all fees, AFIC, Argo, Australian United Investments are internally managed and don’t engage in this double dipping. The double dipping primarily occurs in the Externally Managed LIC space, also, there are one or two good ones in the Externally Managed space, BKI, is externally managed and charges very low fees and has very honourable management.

VGI when it started, also had exceptionally credible management and a good reason for the setup of the LIC, it didn’t work unfortunately and has since been sold.

These are the few.

In another post, I’ll outline some of the adjusted fees charged by many of the externally managed Listed Investment Companies.

A Bunch of LIC Heads Series

As discussed, I’ll be doing further posts on LICs, outlining the following items which I think are essential to appreciate for any investor and sadly, in my opinion, make the “good” LICs, completely inferior to an ETF.

How the LIC structure traps investors.

Why LICs will continue to decline.

Why LICs are incredibly vulnerable to tax reform, and how LICs particularly endanger investors capital.

As always, I’d love to hear your thoughts, please don’t hesitate to reach out,

Thanks,

Andy

andy@iwadvice.com.au

Some important disclaimers: This blog and its posts are written to educate Australians on their financials, anything in this post is solely general information and commentary. All of the information referenced and provided has been sourced from publicly available information and all attempts have been made to ensure everything is accurate. All information is current as of the publishing date of 29th September 2023, and may change in the future, it is important readers conduct their own research and ensure that any figures below remain current at the time they read. There is every chance the fees displayed and discussed may change in the future.