Yellow Brick Road, who’s behind the curtain?

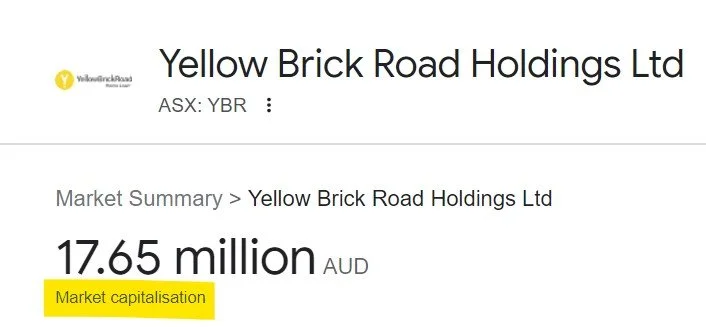

A bit different from my usual stuff on fees and super, but recently I was triggered by FinTwit’s finest, which kindly outlined the incredible ratio of market cap to chairman remuneration for Yellow Brick Road Holdings, outlined below:

Needless to say this is a rather unusual ratio….

Those are rookie numbers Richard Goyder

YBR is about to delist from the ASX.

The AFR has done some great coverage on this, although I thought Mark Di Stefano’s was a little over the top, only because his use of the term “perma-tanned” gives a negative implication for pale people, e.g. people that spend most of the day in an office, reading the AFR and going through annual reports of soon to be delisted penny stock Yellow Brick Road (YBR).

YBR is of course well known as being the second mortgage act of Wizard Home Loans founder & Australian Host of the Apprentice, Mark Bouris.

Let’s just say it’s been less than fairytale. It’s worth noting I’ve never actually seen the Wizard of Oz, so there are probably some low-hanging zingers I’ve missed, I’m sure there’s a good tin man or cowardly lion reference, but lets persevere anyway through this.

Below is a computer generated simulation using AI (Andy’s Intelligence)

But wait, not all shareholders, because whilst all shareholders are equal, some are more equal than others…..

And it is here, in the shareholders, that YBR becomes more interesting, as in YBR’s august history, lies a cast of some big and honestly unexpected names in Aussie finance.

Those that fail to learn from history are doomed to repeat it

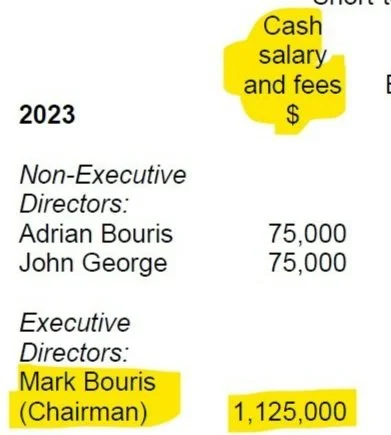

Before that though, it’s worth confirming, that indeed YBR started it’s life on the bourse via a Reverse Take Over also known as a backdoor listing. For anyone wondering, as the connotations of the word might imply, a backdoor listing is almost never a good sign.

Fittingly, by delisting this fashion, YBR appears to be leaving out the backdoor as well.

If you do a backdoor listing, it could be argued that you don’t have the support for an IPO or don’t meet the listing requirements of the ASX.

Shareholders

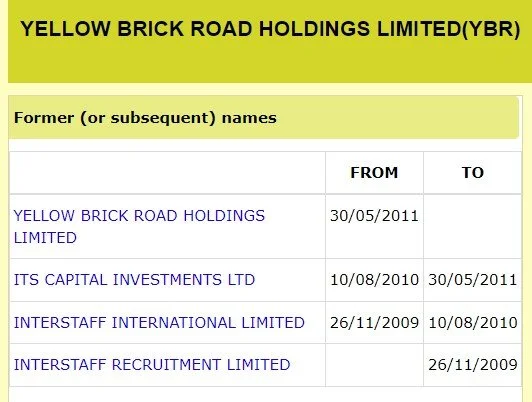

But enough about history, it’s 2023, tell me the characters. Here’s the top shareholders, courtesy of the 2022 Annual Reports:

In a less mundane and more english form, here are the interesting ones:

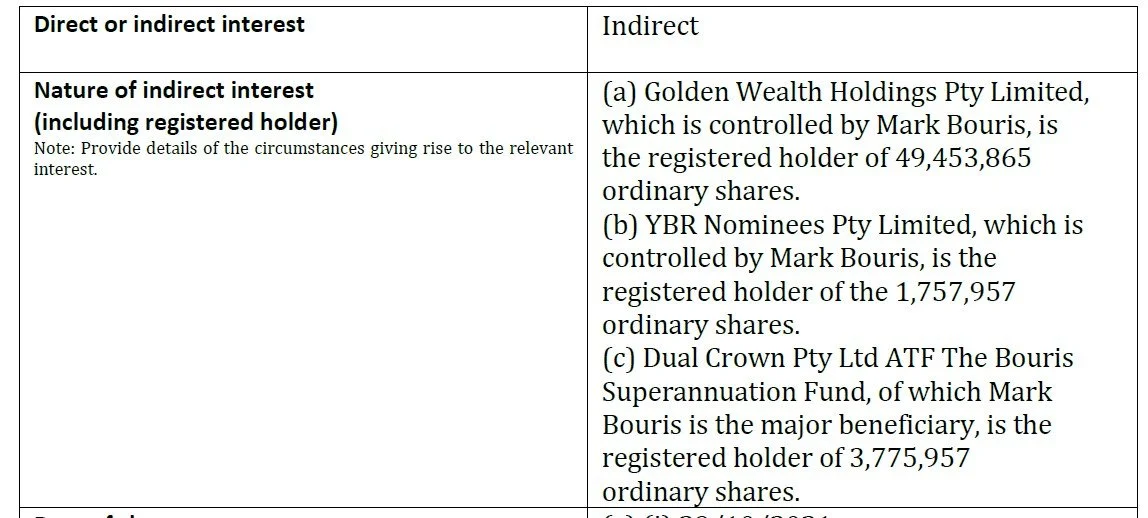

As mentioned earlier, Mr Bouris is paid $1,125,000 for his role as Executive Chairman, specifically, he’s paid to his corporate vehicle, Golden Wealth Holding Pty Ltd. This was contracted for another three years in FY23.

Sandon Capital are an activist fund manager. An ‘activist’ fund typically seeks out companies that have a dysfunctional share price and need agitation to do better.

Magnetar are a US hedge fund, who I believe after I paid the $19 to ASIC to read the annual accounts for YBR JV Resi Wholesale Funding Pty Ltd, are the owners of the other 50% via Delaware domiciled Sunshien Bright LLC, i.e. they have a funding arrangement with YBR, which makes perfect sense, is a good move for both parties and isn’t spicy in any way.

The picture below has no real meaning or relevance but far out it has to be close to absolute peak Bouris.

Wanna buy a mortgage?

As for the other names, well the Boura-Saurus is represented via the following appropriately epicly-named structures;

I also would have accepted Jewel Crown

Idiot Box

But the Bouris family entities aren’t even the most epic name on the register, for YBR’s register sports a monotreme, cop that Vanguard and State Street, you pathetically-named embarrassments.

Pink Platypus Pty Limited, which is a subsidiary of Nine Entertainment aka Channell Nine, sits on over 15% of the company.

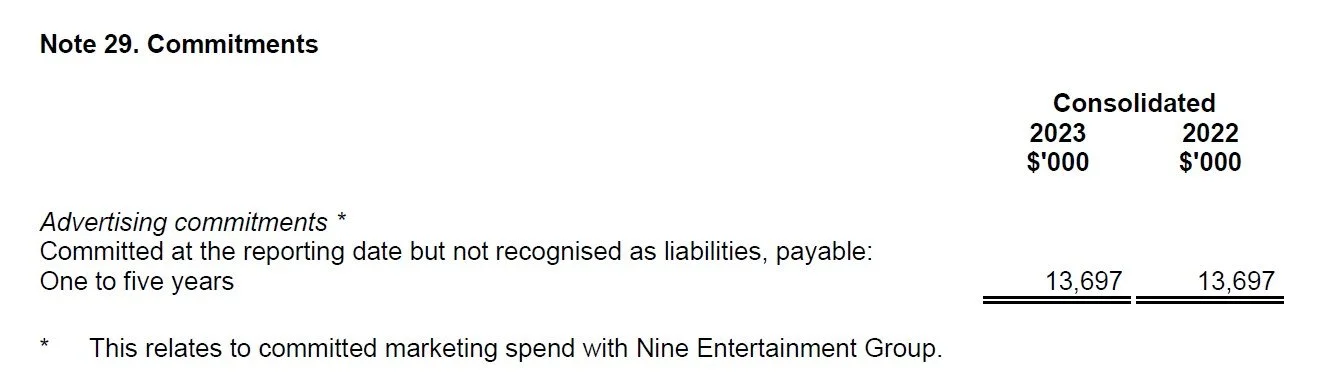

It’s worth noting Nine Entertainment represents aka a huge marketing expense (and marketing provider) for YBR..

People who waste money on Netflix are not responsible enough to handle a mortgage apparently

Additionally, let us pay homage to the fact that it’s thanks to Channell Nine that we witnessed all 1 season and 10 episodes of The Apprentice Australia and no less than FOUR SEASONS and 47 EPISODES OF The Celebrity Apprentice Australia starring Mr Mark Bouris as CEO.

Interestingly The Mentor was featured on The Seven Network, which disappoints me and strikes me as odd, but anyway.

Nine’s holding in the company isn’t all that surprising when you consider how much money the Packer family made from being an investor in Bouris’ Wizard Home Loans, which specifically, was a ‘shitload’.

It’s also worth mentioning that YBR has “Committed marketing spend” with Nine, at least someone still believes in free-to-air, although, do you really want the mortgage of someone who’s watching 4pm re-runs of Mash?

I’d wager most of the remaining free to air watchers would be more susceptible to advertisements for twisties, bic lighters and gatorade bottles…. Either that or hearing aids and walking sticks.

You’re, not, fired

As outlined by the AFR in the 2022 and 2021 AGMs, more than 25% of shareholders voted against the remuneration arrangements, one key investor it seems lead this charge……

As more than 25% of the votes were cast against, this constituted the second strike for the purposes of the Act, this should as pointed out by the AFR triggered a board spill.

However, in both years, the move was shot down, presumably not just from the collective Bouris’ (Mark & his younger brother Adrian), but virtually all supported the executive renumeration aside from a few small frys one significant shareholder.

Again, Magentar, a US-based hedge fund operates a wholesale funding JV with the company (Resi Wholesale Funding Pty Ltd) and Pink Platypus, a subsidiary of the Nine Network which has lucrative and committed marketing spending arrangements with YBR.

Genuinely have no idea who the stick in the mud is, and, they’re unable to do anything regardless thanks to the make up of the register. I’ve no idea if a third strike makes a difference.

The Smartest Guys in The Room

But onto professional investors and finance types, inexplicably, Macquarie found themselves on the register.

Per the AFR “Macquarie became a YBR partner, equity holder, mortgage funder and home loan white labeller in 2012”, perhaps it was this grand illusion of distributing mortgages that lead the “smartest guys in the room” with the bank at one point owning 18.4% of the company.

Nevertheless, Macquarie has been offloading stock for years and in a fashion typical for Macquarie apparently managed to trade the majority of their shit sandwich to other kids on the playground.

Totally unrelated, Macquarie actually bought another business named Yellow Brick Road, a European telephone book business the Yellow Brick Road Group for $3.03 billion in 2005. i.e. the European version of the Yellow Pages, for €1.8bn ($2.3bn) in 2005.

I’d make love to a Nazgul right now if it meant I could get some freaking exit liquidity

I can’t find any data about how it went, but considering not many people use telephone directories, I suggest MQG refrain from any future businesses named Yellow Brick Road.

Still, if you’re in a Yellow Brick Road franchise, you’d seriously want to hope that you are the smartest person in the room.

The Smartest Guy in The Universe

But enough about the smartest guys in the room, and onto perhaps one of the more interesting and unexpected persons to appear in YBR’s history, who is none other than bond & fixed income stud, Christopher Joye.

The perfect corporate photo doesn’t exi……

In late 2012 when Macquarie were loading up on some future capital gain tax offsets, 2.5 million shares was acquired by Coolabah Ventures, a company controlled by Christopher Joye.

Turns out Smarter Money Investments, was originally a joint venture of Yellow Brick Road and Coolabah Capital. It started originally with a 50/50 interest when started in October 2011.

It was originally called “YBR Funds Management Pty Ltd”, however at some point it was renamed to Smarter Money Investments Pty Ltd, per the 2015 YBR annual report, late 2014 according to here.

This was perhaps one of the most successful YBR investments, as at 16th of March 2015, the Smarter Money Active Cash and new Smarter Money Higher Income total FUM exceeded $250m, growing to $340m at 30 June 2016 as disclosed in the YBR 2016 Financials.

Then per the 2017 Reports;

2018 was less forthcoming, but did tell us:

Naturally, Darwinism prevailed and YBR sold their 50% holding to Coolabah Capital in 2019 for $7.5M cash.

Smarter Money Investments Pty Ltd was chaired by Adrain Bouris, brother of Mark and director of YBR, at least was disclosed as being so as recently as the 2019 Financials for YBR.

You’d have to say, Smarter Money is definitely the most successful and still-standing joint venture the company had.

Yellow Brick Erode

It’s hard to argue that the optics of the remuneration relative to the market cap looks pretty out of kilter, it’s also hard to argue that the business has delivered on any metric, it has meandered from strategy to strategy, never achieving sustainable profits nor a sizeable market presence, joint ventures have come and go, the most recent being Resi Wholesale Funding Pty Ltd, a joint venture between YBR & a US Delaware company Sunshine Bright LLC, which presumably, is a subsidiary of US hedge fund Magnetar.

Bouris cited to the AFR that he could earn “Twice that amount of money” elsewhere, and he’s probably right, he’s an incredibly successful guy, however, it doesn’t necessarily answer whether it’s right for YBR. Using a rugby league metaphor, if Nathan Cleary is captaining the Penrith Panthers to premiership wins, would Nathan command the same money if he’s playing social Thursday night touch at Camperdown Oval?

Paul O’Malley, the chairman of CBA, and he’s not an executive chairman like Bouris i.e. someone on the tools running the company, took home $849,118 in FY23 in remuneration….

The wealth and insurance businesses have been flogged off for pittances, and any previous brilliance, massively accomplishments and current compensation to management, the company hasn’t delivered meaningful returns or delivered share price returns to investors.

It seems that one major shareholder is pissed off by the remuneration, and with many of the top shareholders having related party dealings, you don’t have to be sherlock holmes to narrow the list. Nonetheless, it seems all major shareholders approve of the delisting, which is a real positive for everyone.

What’s Yellow, Pink & The Colour Red?

Not that I’m an expert, but the formatting on the 2023 Investor Presentation isn’t great for an ASX company, with inconsistent formatting, margins all over the place, erratic use of full stops, and spelling erorrrorrors.

I spoke to one investor, the theory is there’s a colossal loan book with trial commissions and Bouris is a very well-known public figure whose publicity could bring YBR customers, perhaps those elements are valuable, perhaps more valuable off the exchange, but for the long-suffering shareholders of Yellow Brick Road, they can take one solace.

Even if they did buy a glittery, niche, thinly traded investment that’s possibly about to become very illiquid, at least they didn’t buy Pink Diamonds….

I’ll be back to normal programming and blogging more shortly, I’ve got a series coming up on fees, specifically about what I think is the highest fee-charging investments to Australian Investors.

I was simply, like any living being with a heart and eyes, infatuated with the Yellow Brick Road…..

Andy