The Insane Fees and Costs of Listed Investment Companies - Part 2, Eat a LIC

Previously, I’ve outlined how Listed Investment Companies (LICs) double dip, by ramming costs and fees into the corporate structure and essentially get away with a bunch of things that cannot be done with managed funds, ETFs or superfund investments.

But, how big can those fees get? Well, as LIC-Leo on the front page showed us, fudging fat.

LIC-Leo eating what he kills.

Well, to find out how big these fees can get, you don’t have to wonder! Because yours truly went through the annual financial reports of many of the biggest LICs and LIC providers to find out.

The calculations are in essence fairly simple.

Essentially, we know what the management fee is, let’s call it X and in the case of some of the Wilson funds, it’s 1.00% (not including GST).

So, if we know the management fees for the year = 1%. Then, it would stand to reason if the total costs or “Indirect Cost Ratio” aka “ICR” for the fund is simply total costs / management fees = % for ICR.

Again, for all of the LICs I’ve used the total expenses, except for L1, where I removed the withholding tax on foreign dividends.

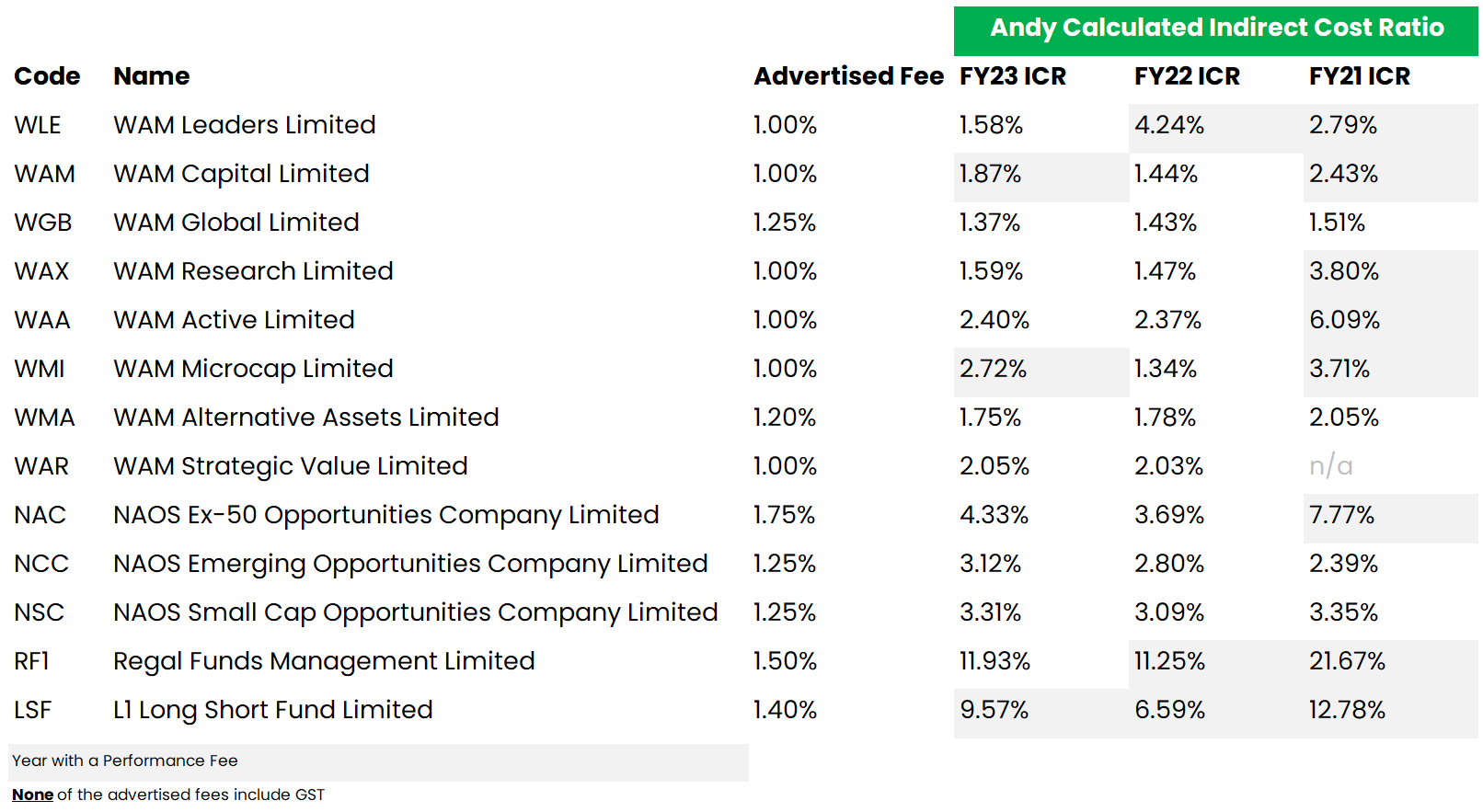

And here’s what you get:

Now fair is fair, some of those fees are astronomically high because they’re in years where there was a performance fee.

But, how about all the years where people are paying anywhere from 1.59% right up to 4.33% for an Australian Equity manager which underperformed the index?

NAOS with NAC bringing in an ICR of 4.33% in FY23 in a year where they underperformed the index.

WAM Active, costing investors 2.40% in FY24, again, in a year where the portfolio underperformed the index.

That’s the investment portfolio underperforming the index, before fees, not the LIC stock itself.

When you include years with performance fees, sweet moses, NAOS’s NAC in FY21, deducting 7.77% in total costs.

WAM Active, slightly outdone with 6.09% in FY21.

Figures of this amount are not not commonplace in managed funds, and pales compared to Vanguard’s ASX ETF which is admittedly passive, but charges 0.07% and is passive, so doesn’t underperform the index….

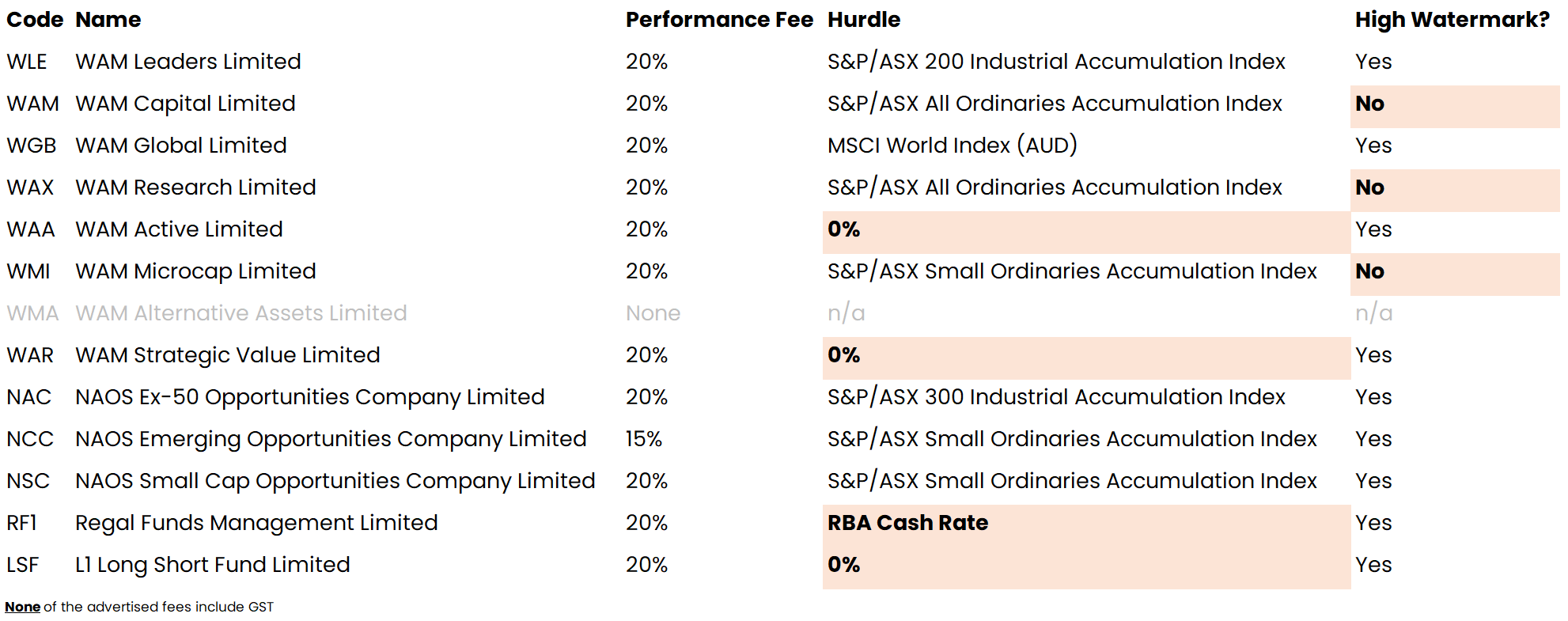

Now, lets look at the makeup of some of these performance fees shall we:

Richly rewarded to underperform, showered with gold to outperform, whether investors see the profits or not.

Why? Just because a manager outperforms pre-fees doesn’t at all guarantee the portfolio will trade, unlike managed funds, or ETFs or superfunds, which do, because they’re not “closed ended” like LICs and LITs (Listed Investment Trust, which RF1 is).

Now there are many LIC managers, but there’s a special reason that these have been included.

Wilson Asset Management aka WAM, the King of LICs

WAM are the kings of LICs. When you think about it, Wilson Asset Management’s business model shares more in common with Wilson Parking than just a name. In essence, both industries aim to get you into a controlled space, charge high fees and then when you go to leave, can be deeply impacted by how much traffic and other patrons are present.

WAM’s first LIC, the of Wilson Capital Limited started way back on the 31st of August 1999. Back then, ETFs were in their diapers, probably was at the time a cost effective manner to get market diversification on a budget. This is definitely no longer the case.

WAM have even launched a LIC that buys other LICs.. That’s right, a LIC, that charges fees, to go invest in other LICs. Specifically, the WAM Strategic Value with the stock ticker “WAR'“.

On one hand, it could offer the ability to buy underperformers at a discount, “buying a dollar for 80c” as so many pundits claim, however, one could argue it allows Wilson Asset Management to climb up the registers of rivals, gaining voting control, meaning they themselves could attempt to take over the management of the LICs. Regardless, is its worth the adjusted ICRs of 2.05% and 2.03% for FY23 and FY22 when they’re not picking any of the stocks? Is that really a fund worth of a 2% ICR?

I’ll probably do another post on WAM, as they’re interesting, and really are the king of LICs, in aggregate WAM they perfectly encompass LICs, bygone of a different era, far too high fees, unacceptable performance fees with zero high watermarks and huge ICRs.

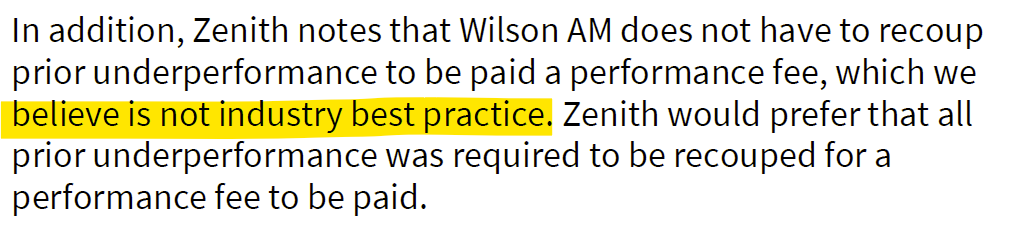

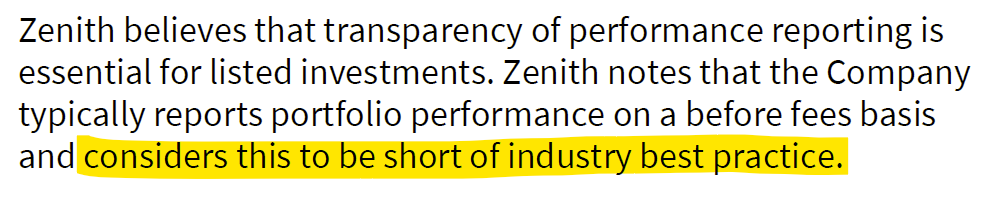

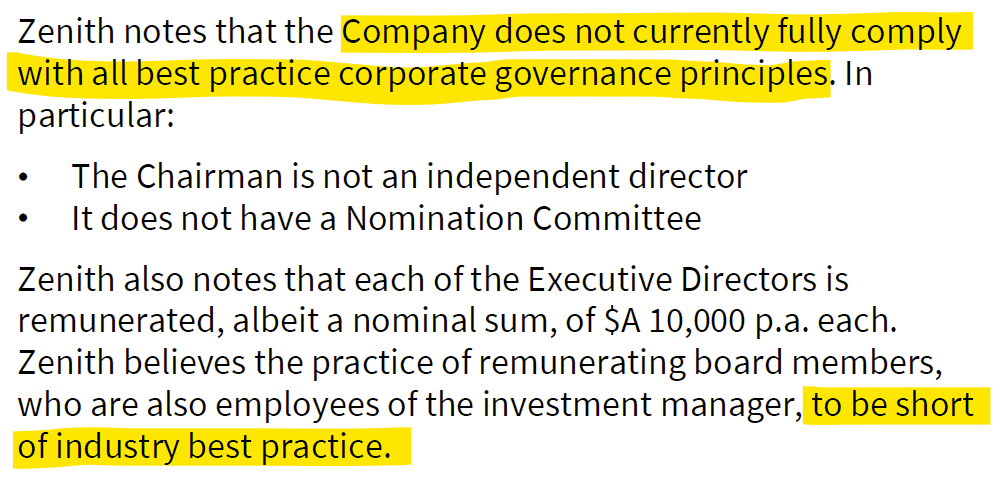

When you read the Zenith, an independent research house, report on WAM Capital there are a lot of mentions of best practice… unfortunately the mentions relate to its absence in a few places…

No high watermark.

Reporting returns pre fees.

Imperfect corporate governance and renumerating employees as directors.

NAOS, a temple to making money

NAOS inspired my interest in LICs. Way back in either 2015 or 2016 I remember seeing NAOS present to our stockbroking firm’s Brisbane office, when I worked at Wilson HTM (no relationship to WAM).

I could not understand how these people who managed a comparatively small amount of money travelled around Australia, wearing impeccable suits, headquartered in Sydney, it just didn't make sense.

Years later when at Macquarie, I raised this with an analyst at Macquarie, how I was perplexed how they stayed afloat. This analyst explained to me the double-dipping fee phenomenon of externally managed LICs.

I have since watched NAOS with great interest, you never forget your first.

In addition to their extremely high costs, albeit they are a small / microcap manager, they seriously perked my interest with their convertible notes…

Essentially, NAOS, which is the Greek word for temples, have gone and built a shrine to money. In Greek Temple Terms, the saucy sausages have managed to find a way to get the statues back from the British Museum and have the poms pay the postage.

This strategy is very interesting, the notes literally pay interest mind you, and to my knowledge unique to NAOS, I don’t any other LICs who do this. Albeit, they may exist.

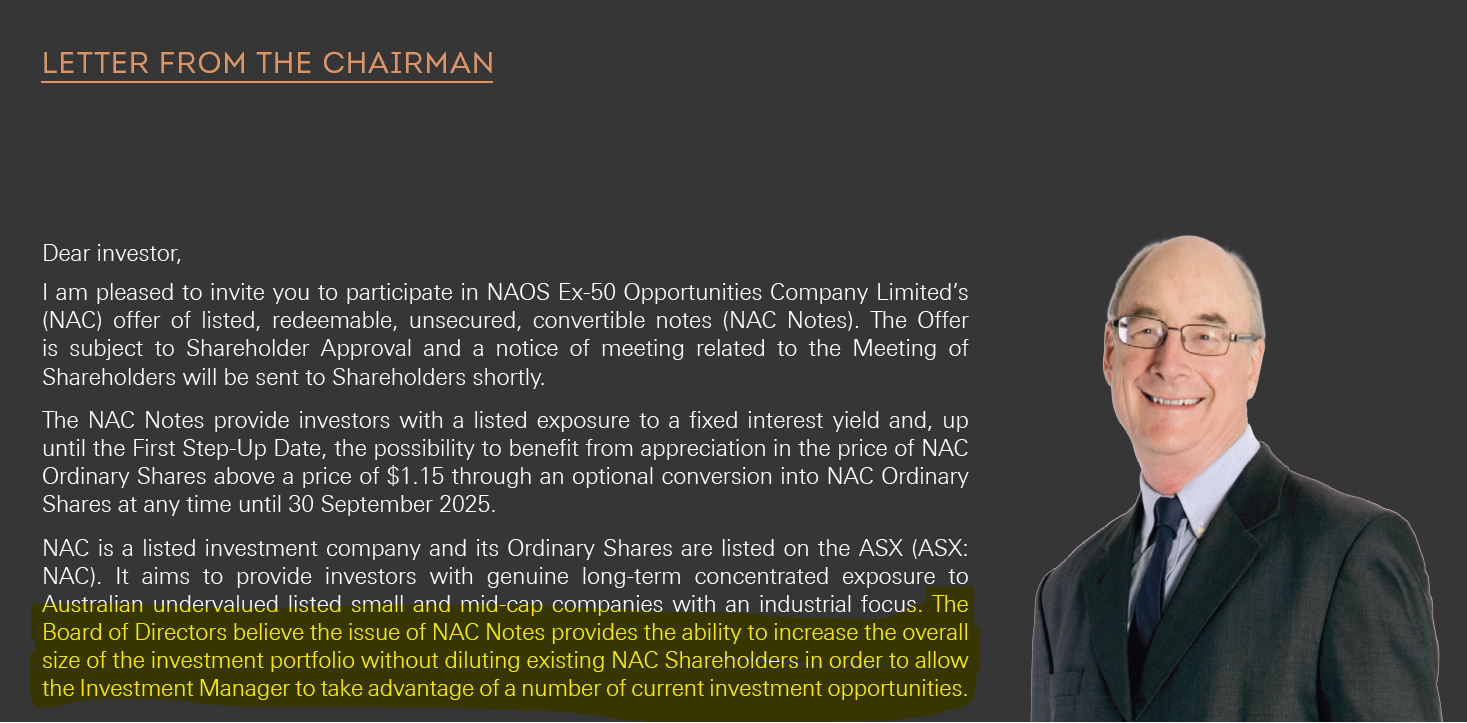

See, for the NAOS Ex-50 Opportunities Company Limited (NAC) and NAOS Emerging Opportunities Company Limited (NCC) LICs, NAOS has raised approximately $17.5M and $23.0M respectively via convertible notes.

Essentially, they raised debt via a convertible note from investors, so that they could invest into their own LICs, thus increasing the assets or “FUM” of the LICs, which in turn increases fees.

Now let me point out - the company had a decent rationale behind this, mentioned below.

Fucking brilliant.

Ergo, the investment would be geared, and considering geared funds include this in their ICR, I think it's logical, albeit, we need to note that this is a geared investment and that does come with higher costs.

Just to confirm, they’ve raised capital from investors, to invest in a vehicle owned by investors, which will pay interest to investors, from monies invested by investors......

NAOS? Pfft, you want a Greek metaphor, this is Midas.

There may have been others that do this, I’m not aware of them, but they might exist.

Also, in the prospectus for the convertible notes, the chairman details the rationale behind them, which is perfectly reasonable in theory, however, which gives rationale for this versus for example a capital raising or a rights issue, however, this type of arrangement, would never be necessary or possible with an ETF, or even a managed fund.

No dilution, but make it rain yo.

The argument is not unreasnoble at all, raise capital to jump on depressed valuations but don’t deprive investors who can’t stump up funds to participate in the raising, but, you cannot deny, it serves the manager very nicely, and….. didn’t they raise the money from investors via the convertible notes anyway? Are those investors getting a worse deal? A better deal? Just a different deal?

A better deal? Buy an ETF that doesn’t run into such…. interesting arrangements.

L1 Capital aka Peak LIC

Now onto L1 Capital, the highly regarded managers who went and ruined the LIC party for everyone. See, there were two big managers who came to market with a LIC, in L1 Capital’s case, they already provided managed funds to everyone, from super funds to individual Mum & Dad investors, begging the question, why would I invest in the LIC which charged higher fees and higher performance fees, when I could just buy the managed fund?

But what L1 did was genius, they marketed the thing like demons. How? They went on a slick roadshow, outlining their incredible performance and stellar process, but most crucially they paid stamping fees. That meant every stockbroker who sold their stuff, got a “stamping fee” in lieu of brokerage, which is reality was about 1.50% of the amount they sold to their clients (could have been slightly less depending on the amount sold). This 1.50% commission was paid in cash to the adviser / stockbroker / financial planner as… a sales commission…

I remember working at Macquarie at the time in the Brisbane office, the salespeople came around and said, look guys, the portfolio manager superstars are running late, so they did an abridged presso, then, took us across the road to a very nice bar/restaurant and said, we have to get so & so on a flight, but fellas, we’ve left the card behind the bar, you guys have a good afternoon on us. Genius. brilliant marketing technique called “reciprocity”.

I heard rumours of brokers putting as much as $10M to $20M into the thing, that’s circa a $150,000 payday.

Unfortunately, shortly after listing the thing absolutely shat the bed, the firm had a long position in Boral that would not play ball and were having all kinds of issues.

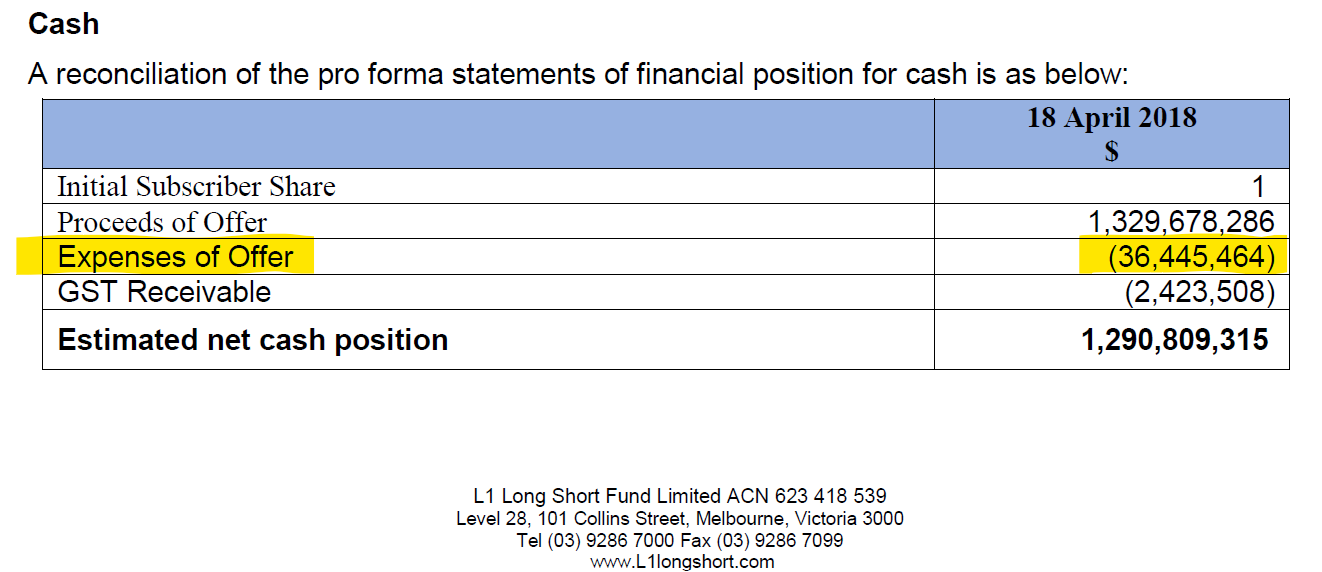

L1 was peak LIC, they raised over $1.3 Billion dollars. Of closed capital. It was incredible.

And the $36,445,464 spent in marketing, roadshow, selling costs? Take it out of the investors’ capital silly.

That’s right, spend $36,445,464 marketing a product, that’s “Closed Ended” meaning incredibly favourable to the manager, and then charge the investors capital….

This is what LICs could do. This is how they convinced advisers and stockbrokers to sell $1.329 Billion to their clients.

These costs amount to 3% of the money, so, investors kicked off with $1 of capital and by the time the GST and marketing expenses were done, were left with 97c.

What other industry functions like this?

L1 Capital’s Long Short Fund (LSF) really was peak LIC, and since stamping fees became banned in 1 July 2020 (except for REITs), is unlikely to ever be repeated.

The combination of another incredibly high-performing manager with L1 kind of saturated broker appetite and then the volatile starting performance of LSF, kind of put the kibosh on LICs.

Poor Regal and Firetrail, the big ticket managers who were scheduled for post-L1 after the market lost its lustre, must have been spewing, because it’s incredibly unlikely anyone will ever top the L1 boys.

The l1 boys, by the way, since the teething problems have performed quite well recently, albeit, the fees in the LIC are as shown above, truly incredibly high.

The performance fee for the LIC for L1, is on net performance, i.e. any performance.

Also, L1 Capital runs an identical managed fund, which in FY22 had an “Annual Fees and Costs” in the PDS of 5.53% per annum, inclusive of everything, versus the 6.59% of the LIC. Already incredibly high fees, more expensive, just because of the LIC.

I note that L1 Capital via LSF and Regal Funds Management Limited via RF1 do a lot of shorting, which is super expensive, and that is a good and reasonable explanation for why their fees are so much higher.

This is just one reason LICs suck

Again, this just part two, Eat a LIC, there are plenty of other reasons LICs suck.

Next week, we’ll look at how many LICs trade at discounts, and how completely wrong the old adage is “buying a dollar for 80c”, this unfortunately applies to all LICs, including the good ones, who charge low fees, as opposed to the externally managed lords show above.

Thanks,

Andy

Some important disclaimers: This blog and its posts are written to educate Australians on their financials, anything in this post is solely general information and commentary. All of the information referenced and provided has been sourced from publicly available information and all attempts have been made to ensure everything is accurate. All information is current as of the publishing date of 5th October 2023, and may change in the future, it is important readers conduct their own research and ensure that any figures below remain current at the time they read. There is every chance the fees displayed and discussed may change in the future.